Depreciation tax shield formula

For instance if the tax. Depreciation tax shield formula.

Tax Shield Formula Step By Step Calculation With Examples

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240.

. How are tax shield benefits calculated. These assets continue to be a part of the balance sheet unless they are sold or destroyed. On the other hand if we take the.

Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues. Interest Tax Shield Definition. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie. Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

For example Below we have two segments. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. What is the amount of the.

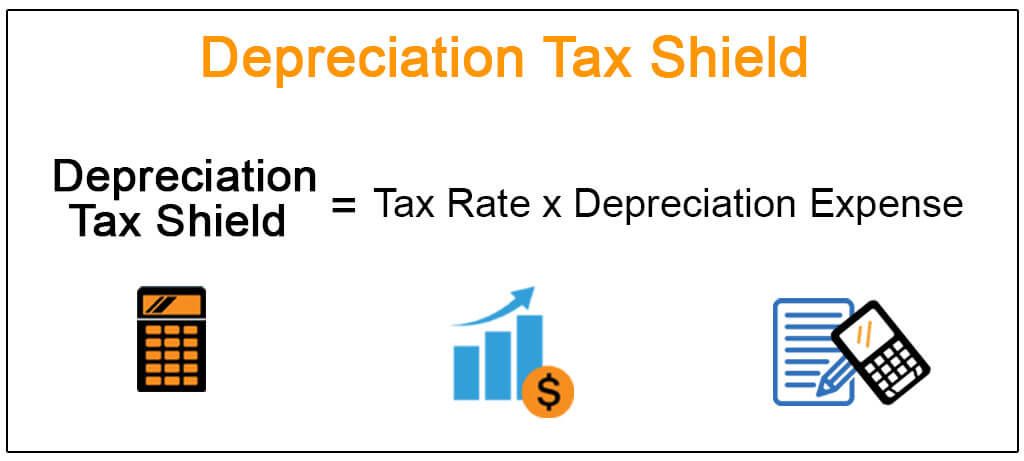

A depreciation tax shield is the amount of tax saved due to depreciation expense which is calculated as depreciation debited as expenses multiplied by the applicable tax rate to. Depreciation tax shield Depreciation expense x tax rate. Although depreciation is a familiar term to many business owners most do not really know and understand how to take advantage of it to reduce their tax bills.

As you will see below the Interest Tax Shield formula is nearly the same as with the Depreciation Tax Shield. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. There are two simple steps to calculate the Depreciation Tax Shield of a company or individual.

In the final step the depreciation expense typically an estimated amount based on historical spending ie. A percentage of Capex and management guidance is multiplied. Depreciation Tax Shield Formula Depreciation expense Tax rate.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. 75000 The correct answer is a. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

It is important to have the depreciation numbers along. It implies that the entire depreciation has been provided in the accumulated depreciation account. To calculate the Interest Tax Shield you simply multiply the.

Interest Tax Shield Definition The value of a tax shield can be. Tax rate 40 The first two columns. Depreciation or CCA tax shield depreciation or CCA amount x marginal tax rate 75000 x 35 26250 7.

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

What Is Depreciation Of Assets And How Does It Impact Accounting

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Finance

Tax Shield Meaning Importance Calculation And More